Stocks, capped by growth concerns, still rally in July

2010-08-02 14:55:51

Concerns about growth led U.S. stocks to finish with a whimper on Friday and for the week but still failed to dent much of the market's strong gains in July.

The government earlier reported a slowdown in second-quarter growth, though much of the impact on the market was curbed by other reports showing a slight improvement in consumer sentiment and in Chicago-area business activity.

The Dow Jones Industrial Average /quotes/comstock/10w!i:dji/delayed (DJIA 10,466, -1.22, -0.01%) reversed an early 120-point loss to close down 1.22 points, or 0.01%, at 10465.94.

That puts the measure up 7.1% on the month -- the first positive month for U.S. stocks since April and the best month since last July, when stocks were in the midst of a 70% bull run.

The gains have come as a strong set of second-quarter earnings provided a big source of encouragement to investors after they spent much of May and June fretting over the impact of euro-zone debt troubles and China's efforts to put the brakes on its growth. Read more on markets' July performance.

Markets Hub: Earnings maybe not strong enough

Over 70% through the 2Q earnings season, profits look to have grown 42% and profit margins nearly 10%. But a closer look at the reports still shows signs of weak consumer spending, with companies benefiting largely from cost-cutting, leaving stocks to question the outlook. There are exceptions - most notably Apple. Paul Vigna, Michael Reid and George Stahl discuss.

The S&P 500 Index /quotes/comstock/21z!i1:in\x (SPX 1,102, +0.07, +0.01%) 0.01% Friday to finish at 1101.59, just above the psychologically important 1100 level. It's up 6.9% this July.

The Nasdaq Composite /quotes/comstock/10y!i:comp (COMP 2,255, +3.01, +0.13%) , meanwhile, gained 0.13% to end at 2254.70, also up 6.9% for the month.

"This month, it has been a good reprieve from the past two months," said Wasif Latif, vice president of equity investments at USAA Investment Management. "Although the guidance may be a little tepid for the third and fourth quarters, net it was a very good earnings season."

He added: "The fact that the economic data have been mixed and not all negative wholesale is probably a positive. What a sigh of relief that we may not be double-dipping."

With 70% of the S&P 500's companies having reported through Thursday, earnings are now estimated to total $19.26 a share, up 42% from $13.51 share a year ago, according to Howard Silverblatt, senior index analyst at S&P. Sales are up 9% and profit margins are sitting at 9.7%.

Still, July's gains have come on thin volume, a sign there may be less conviction behind the climb. This month, only two trading days have seen volumes reach or exceed the daily average of about 5.4 billion shares in NYSE Composite volume.

Mike O'Rourke, strategist at brokerage firm BTIG, said investors were cheered by the strong corporate numbers as well as by tepid signs of the recovering economy.

"Earnings have been great, better than most people expected," he said. "The selloff was overdone and we had hit extreme levels of pessimism."

Still, he said many were concerned about the volatility in July, which saw several days in which the Dow gained or fell by 100 points or more. "I think people would like to see some of this volatility settle out of the market," O'Rourke commented.

A robust economic recovery remains far from certain, with persistently high unemployment continuing to constrain consumer spending.

Underscoring those worries, the government on Friday morning reported 2.4% economic growth for the second quarter, smaller than an expected increase on the first quarter's growth.

Leading the Dow gainers were shares of Home Depot /quotes/comstock/13*!hd/quotes/nls/hd (HD 28.51, +0.46, +1.64%) , up 1.6%, followed by Alcoa /quotes/comstock/13*!aa/quotes/nls/aa (AA 11.17, +0.15, +1.36%) and Boeing /quotes/comstock/13*!ba/quotes/nls/ba (BA 68.14, +0.92, +1.37%) , both of which rose 1.4%.

Weighing on the downside was Merck /quotes/comstock/13*!mrk/quotes/nls/mrk (MRK 34.46, -0.60, -1.71%) , which dropped 1.7% after the drug company's second-quarter earnings fell 52%. Merck's revenue missed expectations, and the company narrowed its 2010 earnings forecast while trimming the top end of its sales view for the year.

Genworth Financial Inc. /quotes/comstock/13*!gnw/quotes/nls/gnw (GNW 13.58, -2.21, -14.00%) tumbled 14%. The life insurer swung to a second-quarter profit as its decline in payouts outpaced that in revenue, but growth in core profit didn't live up to analysts' expectations.

In economic data, readings on consumer sentiment and Chicago-area business activity showed some improvement and topped expectations, providing some relief.

The dollar strengthened against the euro, which slipped to $1.3033 in recent trading, from $1.3078 late Thursday in New York. However, the yen rose to a 2010 high against the dollar. The U.S. Dollar Index /quotes/comstock/11j!i:dxy0 (DXY 81.46, -0.08, -0.10%) , which tracks the U.S. currency against a basket of six others, was off 0.1%.

Treasurys rose, pushing the yield on the 10-year note below 3% to 2.90%. Crude futures gained, as did gold futures.

(Marketwatch)

The government earlier reported a slowdown in second-quarter growth, though much of the impact on the market was curbed by other reports showing a slight improvement in consumer sentiment and in Chicago-area business activity.

The Dow Jones Industrial Average /quotes/comstock/10w!i:dji/delayed (DJIA 10,466, -1.22, -0.01%) reversed an early 120-point loss to close down 1.22 points, or 0.01%, at 10465.94.

That puts the measure up 7.1% on the month -- the first positive month for U.S. stocks since April and the best month since last July, when stocks were in the midst of a 70% bull run.

The gains have come as a strong set of second-quarter earnings provided a big source of encouragement to investors after they spent much of May and June fretting over the impact of euro-zone debt troubles and China's efforts to put the brakes on its growth. Read more on markets' July performance.

Markets Hub: Earnings maybe not strong enough

Over 70% through the 2Q earnings season, profits look to have grown 42% and profit margins nearly 10%. But a closer look at the reports still shows signs of weak consumer spending, with companies benefiting largely from cost-cutting, leaving stocks to question the outlook. There are exceptions - most notably Apple. Paul Vigna, Michael Reid and George Stahl discuss.

The S&P 500 Index /quotes/comstock/21z!i1:in\x (SPX 1,102, +0.07, +0.01%) 0.01% Friday to finish at 1101.59, just above the psychologically important 1100 level. It's up 6.9% this July.

The Nasdaq Composite /quotes/comstock/10y!i:comp (COMP 2,255, +3.01, +0.13%) , meanwhile, gained 0.13% to end at 2254.70, also up 6.9% for the month.

"This month, it has been a good reprieve from the past two months," said Wasif Latif, vice president of equity investments at USAA Investment Management. "Although the guidance may be a little tepid for the third and fourth quarters, net it was a very good earnings season."

He added: "The fact that the economic data have been mixed and not all negative wholesale is probably a positive. What a sigh of relief that we may not be double-dipping."

With 70% of the S&P 500's companies having reported through Thursday, earnings are now estimated to total $19.26 a share, up 42% from $13.51 share a year ago, according to Howard Silverblatt, senior index analyst at S&P. Sales are up 9% and profit margins are sitting at 9.7%.

Still, July's gains have come on thin volume, a sign there may be less conviction behind the climb. This month, only two trading days have seen volumes reach or exceed the daily average of about 5.4 billion shares in NYSE Composite volume.

Mike O'Rourke, strategist at brokerage firm BTIG, said investors were cheered by the strong corporate numbers as well as by tepid signs of the recovering economy.

"Earnings have been great, better than most people expected," he said. "The selloff was overdone and we had hit extreme levels of pessimism."

Still, he said many were concerned about the volatility in July, which saw several days in which the Dow gained or fell by 100 points or more. "I think people would like to see some of this volatility settle out of the market," O'Rourke commented.

A robust economic recovery remains far from certain, with persistently high unemployment continuing to constrain consumer spending.

Underscoring those worries, the government on Friday morning reported 2.4% economic growth for the second quarter, smaller than an expected increase on the first quarter's growth.

Leading the Dow gainers were shares of Home Depot /quotes/comstock/13*!hd/quotes/nls/hd (HD 28.51, +0.46, +1.64%) , up 1.6%, followed by Alcoa /quotes/comstock/13*!aa/quotes/nls/aa (AA 11.17, +0.15, +1.36%) and Boeing /quotes/comstock/13*!ba/quotes/nls/ba (BA 68.14, +0.92, +1.37%) , both of which rose 1.4%.

Weighing on the downside was Merck /quotes/comstock/13*!mrk/quotes/nls/mrk (MRK 34.46, -0.60, -1.71%) , which dropped 1.7% after the drug company's second-quarter earnings fell 52%. Merck's revenue missed expectations, and the company narrowed its 2010 earnings forecast while trimming the top end of its sales view for the year.

Genworth Financial Inc. /quotes/comstock/13*!gnw/quotes/nls/gnw (GNW 13.58, -2.21, -14.00%) tumbled 14%. The life insurer swung to a second-quarter profit as its decline in payouts outpaced that in revenue, but growth in core profit didn't live up to analysts' expectations.

In economic data, readings on consumer sentiment and Chicago-area business activity showed some improvement and topped expectations, providing some relief.

The dollar strengthened against the euro, which slipped to $1.3033 in recent trading, from $1.3078 late Thursday in New York. However, the yen rose to a 2010 high against the dollar. The U.S. Dollar Index /quotes/comstock/11j!i:dxy0 (DXY 81.46, -0.08, -0.10%) , which tracks the U.S. currency against a basket of six others, was off 0.1%.

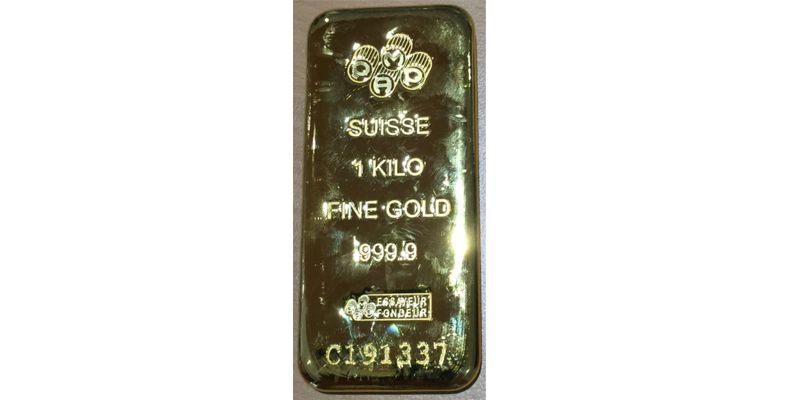

Treasurys rose, pushing the yield on the 10-year note below 3% to 2.90%. Crude futures gained, as did gold futures.

(Marketwatch)

| Thời gian | |||||

|---|---|---|---|---|---|

| Sydney | Tokyo | Hà Nội | HongKong | LonDon | NewYork |

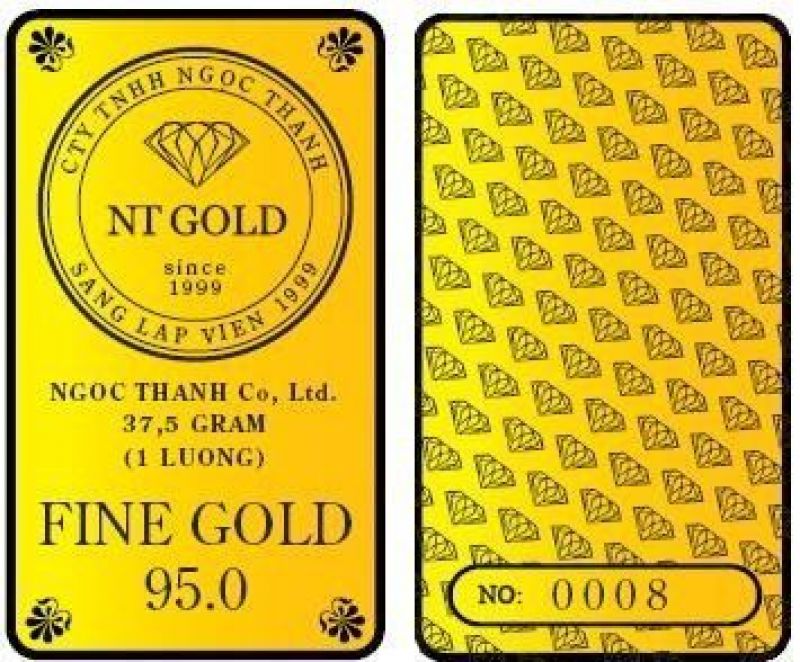

| Prices By NTGOLD | ||

|---|---|---|

| We Sell | We Buy | |

| 37.5g ABC Luong Bar | ||

| 9,488.50 | 8,503.50 | |

| 1oz ABC Bullion Cast Bar | ||

| 7,918.10 | 7,048.10 | |

| 100g ABC Bullion Bar | ||

| 25,205.90 | 22,340.90 | |

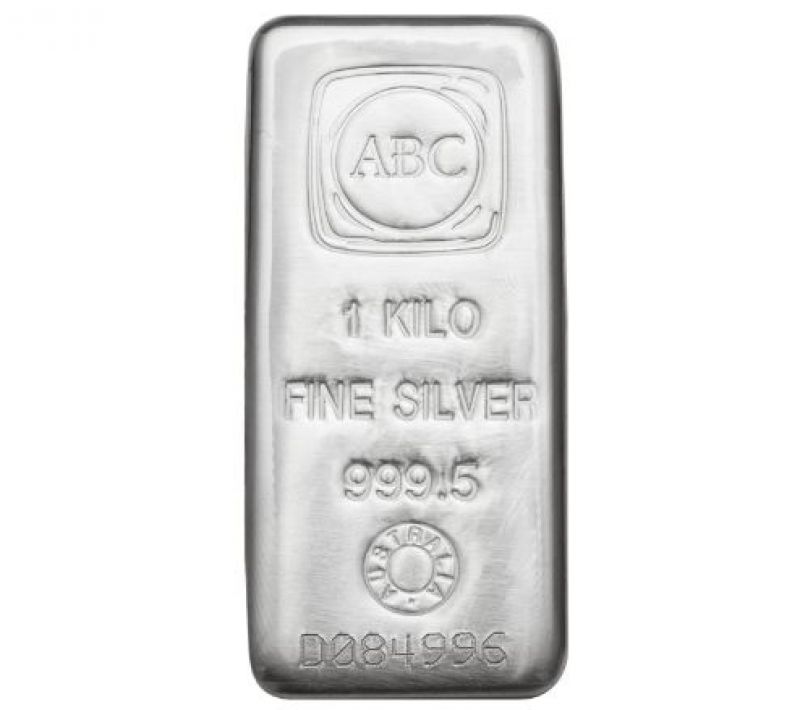

| 1kg ABC Bullion Silver | ||

| 4,986.50 | 3,586.50 | |

Slideshow

Vàng Ngọc Thanh

Lễ trao giải thưởng vàng-đá quý NTGOLD

© 2011 Copyright By Ngoc Thanh NTGold. All Rights Reserved.

Powered by: Ngoc Thanh NTGold

Powered by: Ngoc Thanh NTGold

- Đang online: 85

- Truy cập hôm nay: 869

- Lượt truy cập: 10746428