(Kitco News) - Gold prices are moderately higher in midday U.S. trading Thursday. Some mild safe-haven demand is featured amid two geopolitical developments this week. A weaker U.S. dollar index today is also working in favor of the precious metals market bulls. However, gains in gold are limited by the specter of slower global economic growth meaning less demand for precious metals. June gold futures were last up $4.20 an ounce at $1,285.60. July Comex silver was last down $0.092 at $14.77 an ounce.

World stock markets were mostly lower overnight. U.S. stock indexes are solidly down at midday. The U.S.-China trade war is escalating, with both sides digging in their heels and threatening new sanctions on each other. Chinese trade officials are in Washington Thursday to continue discussions. New U.S. tariffs on Chinese imported goods are set to go into effect at midnight tonight, with most now thinking no substantive deal can be reached at this time. President Trump said at a rally Wednesday evening that China “broke the deal” and said moments ago that he has an “excellent alternative” to the U.S.-China trade deal. That alternative could mean even more U.S. tariffs slapped on China’s imports.

World government bond yields are declining amid concerns an escalation in the trade war between the world’s two largest economies will lead to slower global economic growth. That would be bearish for commodity markets, including the metals, due to less producer and consumer demand.

The Chinese yuan Thursday fell to its lowest level against the U.S. dollar since January.

The U.S.-China trade conflict is presently overshadowing another potential geopolitical flashpoint. Iran’s government said this week it will stop complying with some commitments it made in the United Nations nuclear deal in 2015. This week the U.S. sent a naval task force to the Persian Gulf, including an aircraft carrier, due to what the U.S. said were threats against the U.S. in the region. One miscalculation by either side could lead to serious military conflict.

The other key “outside market” today sees Nymex crude oil prices weaker and trading around $61.50 a barrel.

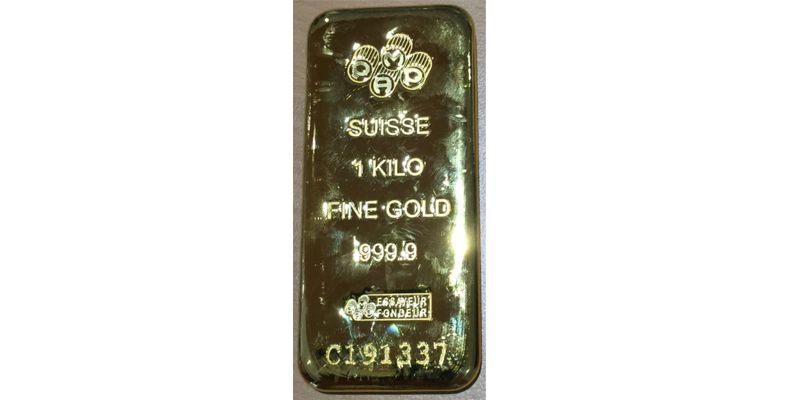

Technically, June gold futures prices closed near mid-range today. The bears still have the overall near-term technical advantage. A 2.5-month-old downtrend is still in place on the daily bar chart. Gold bulls' next upside near-term price breakout objective is to produce a close above solid technical resistance at $1,300.00. Bears' next near-term downside price breakout objective is pushing prices below solid technical support at $1,250.00. First resistance is seen at this week’s high of $1,292.80 and then at $1,300.00. First support is seen at this week’s low of $1,278.10 and then at $1,275.00. Wyckoff's Market Rating: 4.0.

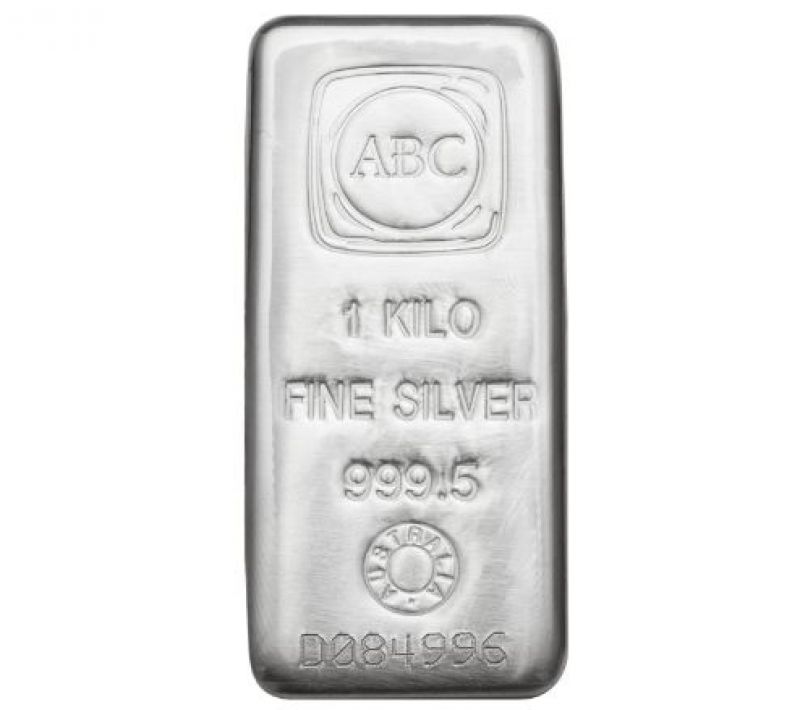

July silver futures prices closed nearer the session low today. The silver bears have the firm overall near-term technical advantage. A 2.5-month-old downtrend is in place on the daily bar chart. Silver bulls' next upside price breakout objective is closing prices above solid technical resistance at $15.25 an ounce. The next downside price breakout objective for the bears is closing prices below solid support at the November low of $14.175. First resistance is seen at today’s high of $14.875 and then at $15.00. Next support is seen at today’s low of $14.705 and then at last week’s low of $14.57. Wyckoff's Market Rating: 3.0.

July N.Y. copper closed down 135 points at 276.10 cents today. Prices closed nearer the session high today and hit a 3.5-month low early on. The copper bears have gained the overall near-term technical advantage. Prices are in a three-week-old downtrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 291.35 cents. The next downside price objective for the bears is closing prices below solid technical support at 265.00 cents. First resistance is seen at Tuesday’s high of 281.00 cents and then at this week’s high of 284.85 cents. First support is seen at today’s low of 273.10 cents and then at 270.00 cents. Wyckoff's Market Rating: 4.5.

![Live 24 hours gold chart [Kitco Inc.]](https://www.kitco.com/images/live/gold.gif?0.2924175530478188)

![Live 24 hours silver chart [ Kitco Inc. ]](https://www.kitco.com/images/live/silver.gif)